Why Every Attorney Over Age 35 Should Consider an Asset Protection Trust – Now!

By Phil Rarick, Esq.

May the odds be with you – but frankly they are not:

- A recent study indicated that the average lawyer can now expect three legal malpractice claims during his or her career.

- The overwhelming majority of legal malpractice claims — over 65% — are brought against firms with five or fewer attorneys.

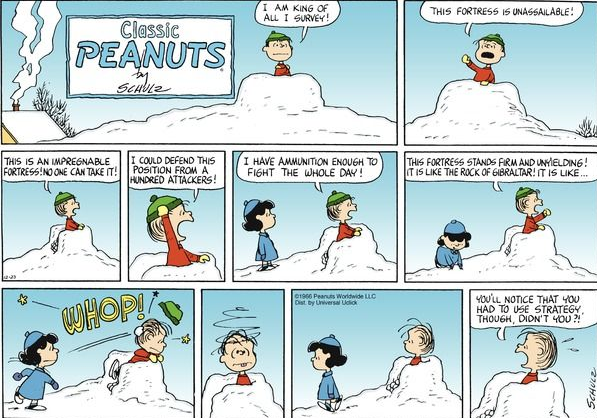

Our firm concentrates on estate and asset protection planning – helping small business owners protect their business and savings in good times and bad. Although most of our high risk clients inquiring about an asset protection trust are doctors, we are getting more calls from attorneys. For good reason. Our over-all goal is to make you an unattractive target against a hostile creditor. We call it our “Porcupine Strategy”: the goal is to take full advantage of Florida law and laws outside of Florida to make your assets as unattractive to attack as a Porcupine would be to a wolf.

The conventional wisdom to minimize legal malpractice risk is a professional insurance policy. No attorney with a small firm needs to be told how the premiums for these policies have been skyrocketing over the past five years. These high premiums should force you to ask if there are other ways to protect you from personal liability. The first letter you will get will demand disclosure of your insurance limits. Insurance is absolutely necessary as a war chest to defend you, but it runs counter to our Porcupine Strategy because rather than make you a more unattractive target, it makes you an enticing prey.

Asset Protection Analysis: Where To Start

Basic asset protection analysis for Florida attorneys starts with taking a look at your complete bundle of assets and dividing them into two columns: Protected and Exposed. Assets such as your homestead, IRA, 401k, life insurance, pre-Paid Florida Tuition, and 529 plans are well protected by Florida law if acquired before the threat arises.

Note: Creditors have a civil remedy to claw back transfers made “with actual intent to hinder, delay, or defraud any creditor of the debtor.” Florida Uniform Fraudulent Transfer Act, F.S. 726. Therefore, timing of transfers is critical.

Assets that are exposed may be your vacation home, investments in rental real estate (this is the lowest of the low hanging fruit), brokerage account, savings account, and boat.

Multiple Options, But Consider a Nevada Asset Protection Trust

A rigorous asset protection plan often has multiple defensive options. For example, your vacation home or rental properties may need to be transferred to a multi-member Florida LLC with a robust anti-Olmstead operating agreement. However, if you have significant non-qualified investments (investments that are not IRA, 401k, or SEP) you likely should consider a domestic asset protection trust (DAPT). Florida does not have laws favorable to creating a DAPT, but many other states do. Based upon a national analysis and my experience, the top tier states are Nevada, Alaska, Delaware and South Dakota, with Nevada routinely ranking first. See Domestic Asset Protection Chart Rankings by attorney Steve Oshins. For more information see our report: Nevada Asset Protection Trust: Your Best Option? A properly structured Nevada APT can protect your equity investments while still giving you control over distributions and how your money is invested.

Timing

As already noted, Florida has a civil remedy law that allows creditors to claw back transfers if there is a known or threatened creditor. This means that Asset Protection Planning must be done when the waters are quiet – before any threat arises.

Two Big Take-Aways

- At a bare minimum, do an asset protection analysis of your bundle of investments and assets. Consider a Domestic Asset Protection Trust as an option for your intangible assets.

- Don’t wait. Most attorneys fail to consider asset protection planning until it is too late. The lesson is clear: do not put this off. Everyone is busy, but protecting your business and family comes first.

We are available for consultations; we charge a flat fee of $400 for the initial consultation and often can give you a flat fee for the proposed asset protection structure that we recommend. Let us know if we can help.

Special Note

The information on this blog is of a general nature and is not intended to answer any individual’s legal questions. Do not rely on information presented herein to address your individual legal concerns. If you have a legal question about your individual facts and circumstances, you should consult an experienced Weston estate planning attorney. Your receipt of information from this website or blog does not create an attorney-client relationship and the legal privileges inherent therein.