By Phil Rarick, Esq.

The Message.

Apparently the message has not got out: In 2011, the legislature threw Florida single member LLC’s under the bus. In a compromise with the bank lobbyists called the Olmstead Patch, multi-member Florida LLC’s (or limited liability companies) were given charging order protection, but a Florida single member LLC receive none. This means a Florida single member LLC can be easily attacked because creditors are not limited to a charging order; rather creditors can foreclose on their interests. See F.S. 605.0503. Olmstead V. F.T.C. Also See Olmstead Patch.

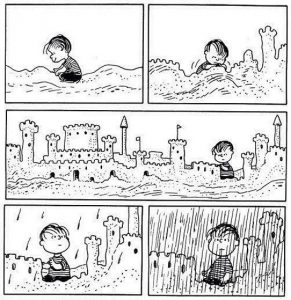

If you have a Florida single member LLC you essentially have a sand castle fortress unless the single member is a limited partnership or multi-member LLC. Here’s why.

The Problem.

In our law practice, we are still seeing small business clients come to us with Florida single member LLC’s because single member LLC’s were exceptionally popular prior to the Olmstead decision for several reasons:

- Simplicity. Many persons were under the false impression that to set up an LLC properly you only needed to file a simple two page Articles of Organization. In fact, the core of every LLC is a robust Operating Agreement that defines ownership interests and rights – and severely limits creditor’s interests and rights.

- Cost. There are numerous online services where anyone without a legal education background can set up a LLC quickly and fairly cheap. Unfortunately, you are not getting what you expect and may be setting yourself up for a blind attack. You may think you have created a fortress against your creditors – but when the rain falls you find out that your fortress quickly collapses.

Warning: On line services should warn you of the severe limitations of a Florida single member LLC. However, I have found none that do. Use such services at your own risk.

- No Tax Filing. A Florida single member LLC can be a disregarded entity and not required to file a tax return. All income is attributed to the single member and reported on the member’s IRS 1040.

So you can set up a Florida single member LLC fairly cheap – but if it does not give you charging order protection what good is it?

What Is Charging Order Protection – and Why Is It So Important

The exclusive remedy for creditors against a Florida multi-member LLC is a charging order. A charging order is usually an unattractive remedy for a creditor because it means they cannot foreclose on their interest; they only have a lien. The creditor only has the right to distributions from the LLC. Typically, if you have a well written LLC Operating Agreement, this will mean that the creditor has to wait until the LLC Manager decides to make a distribution. Rather, than make distributions, the Manager may be able to pay reasonable management fees to other owners or family members for bona fide management services.

Note: A well written Operating Agreement is necessary to help ensure that a hostile creditor has no voice in the management of the company; this means the creditor cannot vote, manage, or liquidate the LLC. No LLC should be formed without an Operating Agreement drafted by an experienced Florida business attorney.

The Fix.

There is good news. While Florida law does not provide much (if any) protection for a single member LLC, the law is quite strong for multi-member LLCs. See Young V. Levy

Here are a couple options for making your Florida LLC a multi-member LLC:

- If married, you can take a 95% interest as tenants by entirety with your spouse, and 5% interest with one spouse. Note: We advise a minimum second interest of 5% but there is no ruling or law defining what interest constitutes minimum interest.

- If you have children, a second option may be to create an irrevocable grantor trust for the education and support of your children. Such trust could hold a 5-10% interest in the LLC.

These are just two options; there are others that you may wish to discuss with your attorney. If it is not feasible or cost effective to have a second member, then you may wish to consider a Delaware LLC because Delaware law does provide charging order protection for a single member LLC.

The Take-Aways.

- Do not rely upon a Florida single member LLC to protect your assets.

- Make sure you have a multi-member LLC and a strong Operating Agreement.

- Consider a Delaware LLC if a multi-member LLC is not feasible.

For more information, contact Phil Rarick, Weston Asset Protection attorney, at (305) 556-5209 or prarick@raricklaw.com.

Special Note

The information on this blog is of a general nature and is not intended to answer any individual’s legal questions. Do not rely on information presented herein to address your individual legal concerns. If you have a legal question about your individual facts and circumstances, you should consult an experienced Weston Asset Protection attorney. Your receipt of information from this website or blog does not create an attorney-client relationship and the legal privileges inherent therein.

Florida Trust & Probate Attorneys Blog

Florida Trust & Probate Attorneys Blog